Alzheimer Calgary is grateful to accept gifts of securities. Securities include stocks, mutual funds, segregated funds, bonds, flow-through shares, and employee stock options.

A gift of securities can have significant tax advantages, helping eliminate the capital gains tax you would incur if you were to sell these assets and then donate the proceeds. Plus, you’ll also receive a charitable tax receipt for your donation.

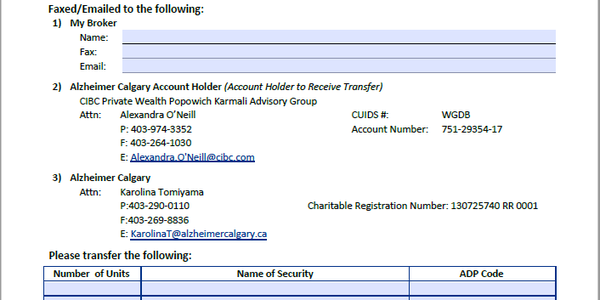

Giving is simpler than you might think – consult your financial advisor for more information and to get the process started.

Please Note: The information on this website is provided for general information purposes only. It is not intended as a substitute for professional advice and assistance from your lawyer, financial advisor, and/or tax consultant. We always recommend that you discuss your plans with your lawyer and/or financial advisor before proceeding with any gift.